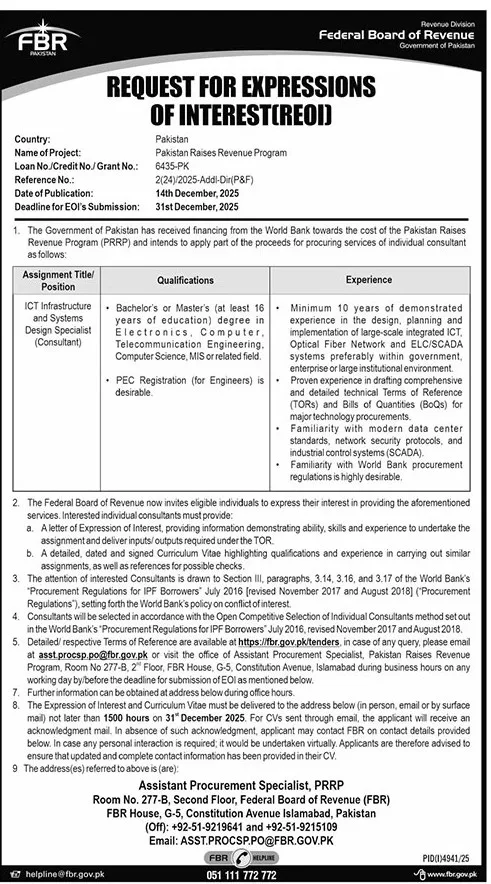

Federal Board of Revenue: Request for Expressions of Interest (REOI) for Consultants

The Federal Board of Revenue (FBR) of Pakistan has initiated a groundbreaking opportunity for experienced professionals in the project management and taxation sectors by releasing a Request for Expressions of Interest (REOI).

Project Overview

Consultant Positions Available

1. Project Director M&E – Track and Trace System (TTS)

- Qualification Requirements:

- Bachelor’s (BS) or Master’s degree in Project Management, Business Administration, Public Administration, Computer Science

- A minimum of 16 years of education

- Experience Requirements:

- At least 15 years of professional experience in Project Monitoring and Evaluation

- Expertise in track and trace systems that monitor tax-related business activities, and a strong understanding of fiscal regulations.

- Proven leadership experience, along with technical and project management skills to design, monitor, and evaluate technology-based systems.

- Strong communication, report writing, and analytical skills to effectively oversee the implementation of this critical technology.

2. Project Manager TTS (Tobacco Sector)

- Qualification Requirements:

- A degree in Project Management, Business Administration, Engineering, or Computer Science from an HEC-recognized institution.

- A preference will be given to candidates with a Project Management Professional (PMP) certification or equivalent.

- Experience Requirements:

- At least 10 years of experience in project management, including planning, executing, and managing complex projects related to taxation or technology systems.

- In-depth knowledge of Track and Trace systems, particularly those that involve the monitoring of excise duty and tax compliance in the tobacco sector.

- Prior experience managing teams in the implementation of large-scale projects, with a demonstrated ability to work within governmental or public sector structures.

- Experience in implementing fiscal monitoring technologies in large businesses or regulatory sectors, ideally in industries such as tobacco, cement, or sugar.

Key Responsibilities

- Design and Monitoring: Develop and implement strategies for the Track and Trace systems within Pakistan’s taxation infrastructure. Monitor and evaluate the progress of these systems to ensure their effectiveness in increasing revenue collection.

- Technical Expertise: Provide advice on the integration of technology into tax monitoring, ensuring compliance with regulatory frameworks. This includes designing systems that use unique identifiers to track taxable goods across production and distribution chains.

- Collaboration: Work closely with FBR officials, international consultants, and other stakeholders to ensure the success of the PRRP. This includes providing technical assistance, conducting training sessions, and offering capacity-building programs for FBR staff.

- Data Analysis and Reporting: Compile and analyze data collected through Track and Trace systems to generate insightful reports.

Application Process

Here are the key steps for applying:

- Submission of Documents: Interested individuals should submit their CVs and supporting documentation to demonstrate their eligibility and qualifications. Applications must be submitted by 8th November 2024.

- Format of Submission: Applicants are required to submit their expressions of interest in both hard and soft copies. The soft copy must be emailed to the designated email address provided in the REOI, and the hard copy should be sent to the FBR’s Procurement Specialist at the PRRP office in Islamabad.

Important Considerations

- Eligibility and Evaluation: The Federal Board of Revenue will evaluate applicants based on their qualifications and past experience in project management, taxation, and Track and Trace technologies.

- Formal Procurement Notice: It is important to note that this call for expressions of interest is a formal procurement notice and not an employment advertisement. Applicants should prepare their submissions accordingly, highlighting their relevant experience in taxation, project management, and technology systems.

Why This Program Matters

The Pakistan Raises Revenue Program (PRRP) is an essential part of the country’s efforts to enhance fiscal capacity and modernize its tax collection mechanisms. By integrating advanced Track and Trace systems, the FBR will be able to significantly reduce instances of tax evasion, increase government revenues, and improve compliance across industries. This initiative aligns with broader goals of economic reform and stability, which are crucial for Pakistan’s long-term development.

Conclusion

The Federal Board of Revenue’s call for consultants under the Pakistan Raises Revenue Program provides a rare opportunity for highly skilled professionals to contribute to the modernization of Pakistan’s tax system. The program promises to implement cutting-edge technology in the country’s revenue collection mechanisms, which will bring about greater efficiency and accountability.