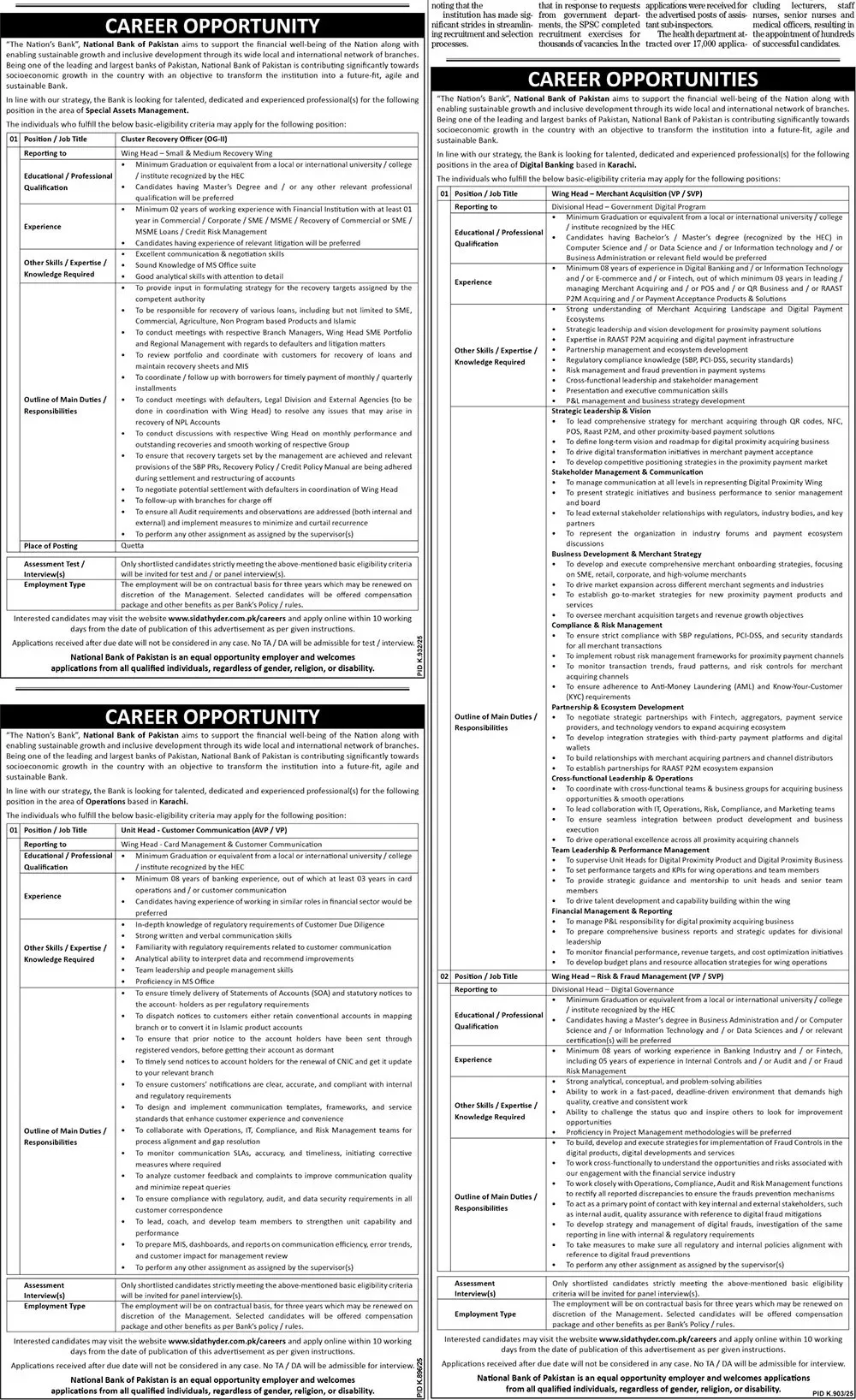

National Bank of Pakistan Announces Major Career Opportunities in Digital Banking, Risk Management, and Customer Communications

National Bank of Pakistan (NBP), one of the nation’s largest and most influential financial institutions, has announced a significant recruitment drive, seeking talented, dedicated, and experienced professionals to join its team. As “The Nation’s Bank,” NBP is on a mission to drive sustainable and inclusive economic growth, transforming itself into a future-fit, agile, and sustainable institution.

This is a premier opportunity for professionals to contribute to the financial well-being of the nation by taking up key roles in the rapidly evolving areas of Digital Banking, Risk & Fraud Management, Customer Communication, and Recovery. The bank has openings in Karachi and Quetta for individuals who meet the rigorous eligibility criteria.

Lead the Digital Revolution: Key Vacancies in Digital Banking (Karachi)

NBP is heavily investing in its digital infrastructure and is looking for a visionary leader to steer its merchant acquisition strategy.

Position: Wing Head – Merchant Acquisition (VP / SVP)

Reporting to: Divisional Head – Government Digital Program

Qualifications: A Bachelor’s/Master’s degree in Computer Science, Data Science, IT, or Business Administration.

Experience: A minimum of 8 years in Digital Banking/IT/E-commerce/Fintech, with at least 3 years in a leadership role managing merchant acquiring (POS, QR, or RAASST P2M).

Key Responsibilities:

Develop and lead a comprehensive strategy for merchant acquiring through QR codes, NFC, POS, and other digital payment solutions.

Drive digital transformation initiatives and manage stakeholder relationships with regulators, industry bodies, and key partners.

Oversee merchant onboarding, manage compliance with regulations like Anti-Money Laundering (AML) and Know-Your-Customer (KYC), and implement robust risk management frameworks.

Forge strategic partnerships with Fintechs, aggregators, and payment service providers to expand the acquiring ecosystem.

Lead and mentor a high-performing team to achieve business objectives.

Strengthen the First Line of Defense: Roles in Risk & Fraud Management (Karachi)

In an increasingly complex digital world, managing risk is paramount. NBP is hiring a strategic leader to safeguard its digital products and services.

Position: Wing Head – Risk & Fraud Management (VP / SVP)

Reporting to: Divisional Head – Digital Governance

Qualifications: A Bachelor’s degree is required, with a Master’s in Business Administration, IT, or Data Sciences being preferred.

Experience: A minimum of 8 years in Banking Industry/Fintech, with at least 5 years of experience in Internal Controls, Audit, or Fraud Risk Management.

Key Responsibilities:

Build, develop, and execute robust strategies for Fraud Controls across all digital products, developments, and services.

Work cross-functionally with Operations, Compliance, Audit, and Risk Management to identify and mitigate risks associated with the bank’s digital engagement.

Act as the primary point of contact for internal and external stakeholders on matters related to digital fraud.

Develop and manage digital fraud and investigation policies in line with internal and regulatory requirements.

Lead the response to digital fraud preventions and investigations.

Enhance Customer Engagement: Join the Card Management & Customer Communication Team (Karachi)

Clear and compliant communication is vital for customer trust. NBP is seeking a professional to lead its customer communication strategy for its card division.

Position: Unit Head – Customer Communication (AVP / VP)

Reporting to: Wing Head – Card Management & Customer Communication

Qualifications: A minimum of a Graduate degree from a recognized university.

Experience: A minimum of 8 years of banking experience, with at least 3 years specifically in card operations or customer communication.

Key Responsibilities:

Ensure the timely and accurate delivery of Statements of Accounts (SOA) and other statutory notices to cardholders.

Manage the dispatch of notices to customers regarding conventional and Islamic product accounts.

Ensure all customer notifications are clear, accurate, compliant, and enhance the customer experience.

Design and implement communication templates and frameworks.

Monitor communication SLAs, accuracy, and timeliness, and analyze customer feedback to improve communication quality.

Lead and develop a team to strengthen the unit’s capability and performance.

Drive Financial Health: Cluster Recovery Officer Role (Quetta)

NBP is also strengthening its recovery wing and is looking for a skilled professional to manage its portfolio in Quetta.

Position: Cluster Recovery Officer (OG-II)

Reporting to: Wing Head – Small & Medium Recovery Wing

Qualifications: A minimum of a Graduate degree is required, with a Master’s degree or other professional qualification being preferred.

Experience: At least 2 years of working experience with a financial institution, with at least 1 year in Corporate/SME/MSME Recovery, Commercial, or SME/MSME Loans/Credit Risk Management.

Key Responsibilities:

Formulate strategies to achieve recovery targets for Non-Performing Loan (NPL) accounts.

Manage various types of loans, including SME, Commercial, Agriculture, and Islamic products.

Conduct meetings with Branch Managers, defaulters, and legal teams to resolve issues and recover outstanding dues.

Ensure that recovery targets are met and that SBP Prudential Regulations and the bank’s Recovery Policy are strictly followed.

Negotiate potential settlements with defaulters and follow up for charge-offs where necessary.

Application Process and General Information

How to Apply: Interested candidates must visit the website www.sidathyder.com.pk/careers and apply online.

Application Deadline: All applications must be submitted within 10 working days from the date of the publication of this advertisement.

Employment Type: The employment will be on a contractual basis for an initial period of three years, which may be renewed at the discretion of the Management.

Compensation: Selected candidates will be offered a competitive compensation package and other benefits as per the Bank’s policy/rules.

Selection Process: Only shortlisted candidates who strictly meet the basic eligibility criteria will be invited for a test and/or panel interview(s).

Frequently Asked Questions (FAQ)

Q1: How can I apply for these positions?

A: All applications must be submitted online through the specified portal: www.sidathyder.com.pk/careers. Applications sent through other means will not be considered.

Q2: What is the deadline for applications?

A: You must apply within 10 working days from the date the advertisement was published.

Q3: Are these permanent positions?

A: No, these are contractual positions for an initial term of three years. The contract may be renewed based on performance and management discretion.

Q4: I am from a gender/religion/disability minority. Can I apply?

A: Yes, the National Bank of Pakistan is an equal opportunity employer and welcomes applications from all qualified individuals, regardless of gender, religion, or disability.

Q5: Will there be a test for all positions?

A: The advertisement states that shortlisted candidates will be invited for a “test and/or panel interview(s).” The exact selection process may vary depending on the position.

Q6: I live outside of Karachi/Quetta. Can I still apply for the positions based there?

A: Yes, you can apply. However, the place of posting for these specific roles is Karachi or Quetta, and you would be expected to relocate if selected.